Introduction

Ethereum, the second-largest cryptocurrency, is one of the most widely used blockchains with over 200 million unique addresses registered at the end of February 2022. The rise of decentralised finance (DeFi) and non-fungible tokens (NFTs) have moved the spotlight on Ethereum and its fast-growing user base. Ironically, it is exactly this popularity that has exposed Ethereum’s weakness: the volatile and extremely high fees that every user has to pay when making a transaction. With over 1 million transactions per day in 2021, some users have even paid more in transaction fees (i.e. US$10, 50 or 100) than the actual value of a transaction (you can see where the frustration comes from).

Not all users have the spare change to pay fees that reward miners for validating blocks. As a result, many critics lean hard on the fact that high-cost barriers go against its core mission to be inclusive and for the people. This is where terms like “Ethereum killers or Ethereum alternatives” were born. With the scalability trilemma still very much slowing down Ethereum, the likes of Solana, Polkadot and, other blockchains find themselves in a great position to dethrone the king of smart contract execution.

However, despite many users paying insanely high gas fees, Ethereum maintains its blockchain popularity amongst the community. People have not written off Vitalik Buterin and Ethereum just yet.

But why? To better understand, let us look at what these high fees mean and why people pay them?

What is gas? Why does Ethereum need it?

Gas is a term for the amount of Ether (ETH), the native currency of Ethereum, needed by the network when a user performs an action. These are transaction fees paid to Ethereum miners to execute and keep the entire network running securely. You can think of gas as the fuel needed to run a machine. Different functions require different amounts of gas. For instance, simply transferring ETH will take less gas than moving ERC-20 tokens, purchasing an NFT or swapping tokens on a decentralised exchange (DEX).

With this understanding, all transactions on Ethereum requires users to pay gas. If users want their transaction (which is stored in a block) to get approved first, they will have to pay higher fees to incentivise miners to validate the block containing your transaction. In other words, gas can act as a user’s bid for ‘block space’.

So, when many people are using the network, the competition for limited block space is high, and in order to get transactions approved, users will need to pay higher gas fees to attract miners’ attention. With real-world dynamics of demand and supply still relevant to a virtual network like Ethereum, block spaces come at a huge premium. The network fees become ever costlier as the price of ETH increases along with increases in base gas fees (the minimum to be paid on every transaction).

Then, why do people still choose to use Ethereum?

In a decentralised crypto world, users have complete freedom to do anything they want. In fact, many frustrated Ethereum users can easily make the switch to a different ecosystem like Solana or Cardano to execute similar transactions without the high gas fees. The growing maturity of Ethereum alternatives are definitely attracting a lot of attention and have converted some of Ethereum’s most loyal fans into their own.

However, a majority are still willing to put up with exorbitant transaction fees and ditch the thought of moving to one of the Ethereum killers. So, the question is, does Ethereum offer users more reasons to stay and pay the premium? If so, what are they?

Decentralisation

Ethereum is one of the most decentralised blockchains compared to its closest competitors. Decentralisation is vital for blockchains to remain secure and prevents malicious users from hijacking the total validating power. The low barrier of setting up an Ethereum miner to start validating transactions, with the current Proof-of-Work (PoW) consensus mechanism, greatly benefits the aspect of decentralisation. With the current emphasis on computational work, malicious validators cannot possibly take control of over 50% of the network’s hashing power to start an attack. They would have to buy an insane amount of processing power, which will cost a fortune before they could gain the majority network power to alter the blockchain.

While Ethereum alternatives are able to offer cheaper fees, they sacrifice decentralisation. This is the cost of the trade-off — a quick look at etherenodes shows that Ethereum has over 6,000 nodes while Solana has close to only 1,500 nodes while 21 node operators control the BSC. The incremental power that each node carries quickly disincentivises validators from launching an attack on the network. Therefore, from the looks of it, Ethereum seems to do better a better job in upholding the widely-shared ideology of decentralisation.

However, some may argue as Ethereum upgrades to a Proof-of-Stake (POS) model (no longer ETH 2.0), validators will need to have a minimum of 32 ETH, which equates to around US$ 155,800 at ATH prices. This new barrier might reduce the number of validators and weaken the decentralisation aspect of Ethereum. On the contrary, data from Glassnode shows that the number of addresses that hold more than 32 ETH is over 125,000. This means there could potentially be over 100,000 validators when the migration takes place (taking a conservative conversion rate of 80%), but this is of course completely dependent on the intentions of these wallet owners.

Ecosystem

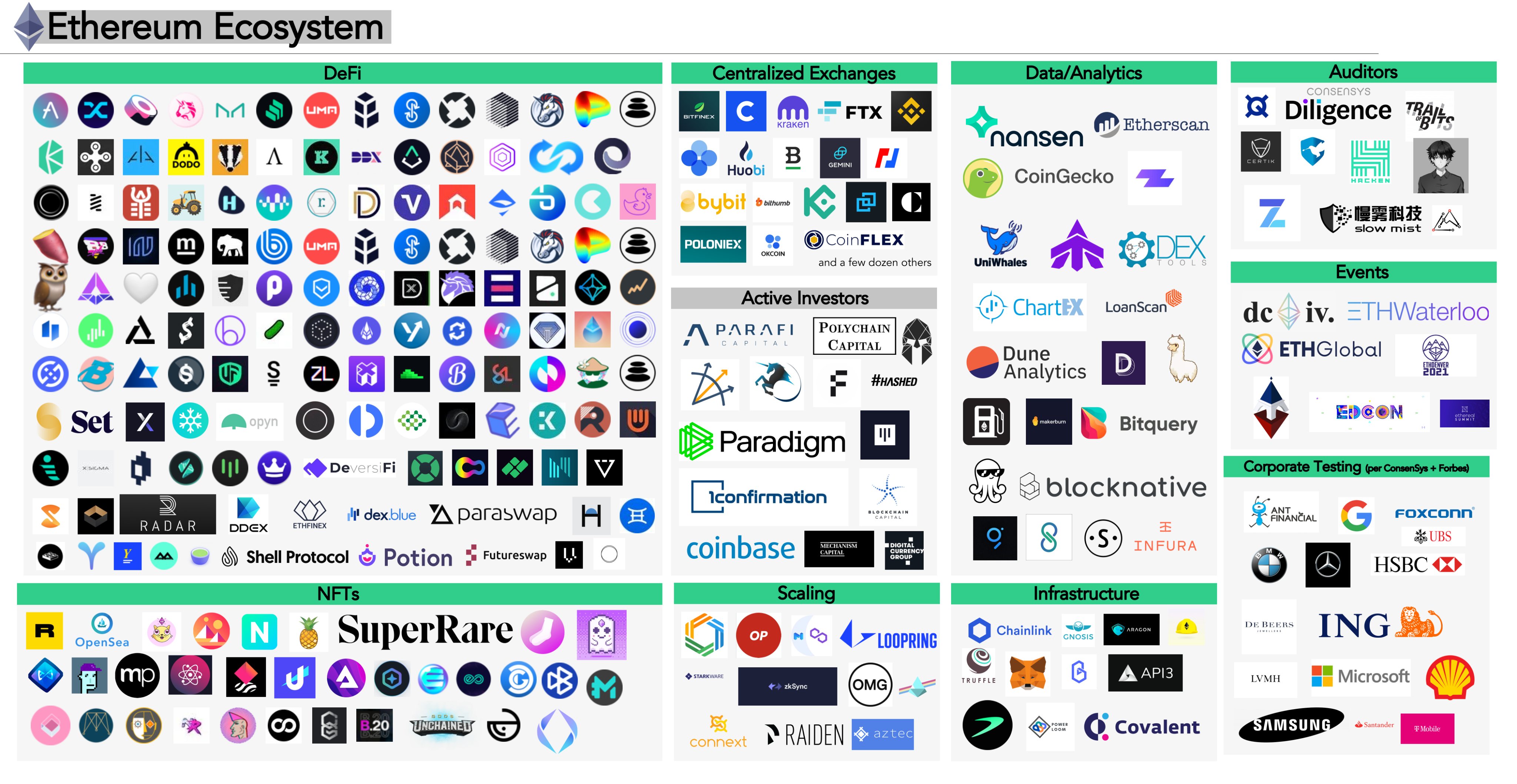

The Ethereum ecosystem is vast and spreads across multiple key areas of crypto. It is arguably the face of a multi-billion dollar, blockchain-based economy, enabled by things like DeFi to digital art. Smart contracts are central to the notion that Ethereum was built to be a highly versatile computing platform that supports a notable DeFi ecosystem that has over US$ 100 billion in total value locked (TVL). Its flexibility has allowed a virtual financial system to flourish – giving rise to DEXs like Uniswap, lending protocols like Compound, oracles like Chainlink and other applications, including stablecoins, storage apps, etc. There are already many blockchain applications that proudly call Ethereum home – almost 3,000 DApps, to be exact. This massive pool of functionality far outnumbers any other platform that exists and acts as the web that compels Ethereum users to stick around (pun not intended).

Ethereum is THE place to be. It is like the party everyone wants to get into because that’s where most people are, and exciting things can happen. In this case, where the hottest NFT projects are. With the recent NFT trends, it is worth remembering that famous NFT collections like the Bored Ape Yacht Club (BAYC) and Cryptopunks are built on the Ethereum blockchain (not on Ethereum killers). This trend continues to grow as new additions like VeeFriends and World of Women have attracted major fan bases and capital compared to lesser-known, alternative blockchain-based projects.

Ask anyone who knows about NFTs or recently discovered NFTs to name a famous Solana-based project; there is a high chance they can’t. This is not to say that other blockchains do not have an exciting ecosystem, but people tend to have FOMO. When all the hype is on Ethereum-based projects, users surely do not want to miss out just because of a little something called, gas fees.

Innovation

The team behind Ethereum is definitely giving considerable attention to the classic “broken, devs pls fix” comments on the blockchain’s high transaction costs. As mentioned earlier, the first stage of the plan to migrate Ethereum to a PoS mechanism is already underway. Ethereum users continue to pour support behind the dream of eventually improving scalability and reducing gas fees through sharding. As the network splits itself and scales up, it would be able to handle 100,000 transactions per second (TPS) – way above today’s currency capacity of 20-30 TPS. This would significantly reduce the network burden and, subsequently, the competition for block space. However, the timeline for implementing these features has been repeatedly delayed and is largely unknown for various testing-related reasons.

While Ethereum prepares for the big shift towards a greener and faster network, users make do with layer 2s (L2s) to scale Ethereum and prevent gas fees from ballooning. Many DApps use these scaling solutions to process transactions off-chain (meaning not on the Ethereum mainnet). This reduces the overall congestion and improves overall transaction speed and throughput, without sacrificing decentralisation or security. As there is no one-size-fits-all solution, many developers have built alternative off-chain scaling methods to help Ethereum survive the surge in transactions. These innovation solutions include rollups (optimistic, zero-knowledge), state channels, sidechains, plasma and many other fascinating technologies that help prevent single points of failure in the network.

Even though Ethereum is dragging its feet on new upgrades, innovation among users looks promising. While a network is only as strong as its community, Ethereum sure has its users to thank for keeping them in the race to be the ultimate smart contract executor.

Are Ethereum gas fees worth it?

Due to the volatility of gas fees, Ethereum can be quite a difficult network to use and tolerate at times, especially during peak volume periods. However, the fact that there is still a consistent level of demand to use Ethereum, despite the volatile and expensive fees that accompany each transaction, proves a huge point – Ethereum is worth paying for.

Until today, many Ethereum users have chosen to stay. They are willing to put up with the high ‘fixed’ cost of using the network even while solutions to combat scalability issues are being perfected. There is a notion that people involved in the crypto space are often built on hope and vision – to be free of legacy systems and to live in a decentralised world. If high transactions fees are what it takes to keep that ideal (or Ethereum) alive, you can be sure these users will “accept & approve” transactions and pay gas fees in a heartbeat.

Even if one is not a big believer in Ethereum’s long-term vision, don’t feel pressured by the crazed, gas-paying fans. Instead, maybe look at what the established brands and institutions are doing. These companies have dedicated teams doing their blockchain pros and cons homework before deciding to use Ethereum in their crypto and NFT adventures. Their decision to buy or transact on Ethereum certainly speaks volumes.

Ethereum remains at the heart of many “Ethereans” and visionary Web 3 builders. There is no doubt it shows great potential for mass adoption. However, users and investors should always be mindful of gas fees and be informed about other blockchains that solve Ethereum’s downsides. As a new user venturing into the crypto space, always DYOR and select the right blockchain to make transactions on. The worst thing is experience is looking at how much gas fees is eating into the value of your transaction. Transact at the right time, when network usage is low and be sure to use layer 2 solutions when possible to save on gas.

Find out other ways to reduce your gas spend, here.

For the readers: do you use Ethereum despite such high fees? are there any other reasons for using Ethereum? or did you switch to an alternative like Solana?